Introduction

Grants are a critical source of funding for many organizations, so it is essential to understand the basics of grant compliance and grant reporting. This practical guide provides an overview of the topics related to both. Grant compliance is a process that ensures organizations adhere to the terms and conditions of the grant.

Depending on the funder, this could include providing programmatic information, financial reports, and documentation to show how funds are being used. Understanding the requirements of each grant can help ensure that all of the necessary documents are collected and submitted in a timely manner. It is important to also recognize any changes or updates required by funders so that organizations can remain compliant with their responsibilities.

Grant reporting is an important part of managing grants successfully; it allows funders to track progress and assess outcomes. Reports should be tailored depending on which type of grant they are associated with and should demonstrate how organizations have achieved their goals within specific time frames. Reports can be written or presented electronically and organizations must select appropriate formats for each unique situation. Additionally, understanding any additional reporting requirements related to contracts or subcontracts is essential for accurate completion of reports.

But, we’re getting a little ahead of ourselves. In this guide we'll explore the following topics:

-

What is grant compliance?

-

Why is grant compliance so important?

-

The best practices for successful grant compliance

-

What are the laws and regulations in relation to grant compliance?

-

What is grant reporting?

-

What is the difference between grant compliance and grant reporting?

-

How to write a great grant report?

-

A brief look at the best grant reporting software, and

-

Much more!

CHAPTER 1

What Is Grant Compliance?

Grant compliance is an essential element of the grant-seeking and grant-awarding process. It refers to the set of rules, regulations, and policies that govern how grants should be managed, from their initial application through to final reporting. Grant compliance helps ensure that funds are used appropriately and as intended by the funding source.

For those receiving a grant, it’s important to understand all aspects of grant compliance so you can effectively manage your project or organization’s needs within the limits of the funding agreement. This means understanding not only financial accounting requirements but also any reporting obligations related to program outcomes or goals set forth in the original proposal. Additionally, you must ensure that all staff members involved in activities funded by grants have clear roles and responsibilities for ensuring compliance with applicable policies and procedures.

The scholarship program can determine what the money received is used for as well. For example, if they want it to strictly be used for state universities or if the funds can be used for community colleges, vocational or trade schools.

Who should know your organization’s grant compliance requirements?

-

Everyone in your grantmaking organization - administrators, review board, customer service personnel, etc…

-

All donors and/or sponsors of the grant.

-

Your grant applicants, and especially your recipients.

Those responsible for administering grants or working with them need to have a strong grasp on all applicable compliance rules and regulations. This includes anyone responsible for developing a program or proposal that will use the funds or assist with its implementation in any way. This could include project administrators, financial staff, accountants, lawyers and other professionals involved in the management of grants.

How is grant compliance achieved?

To achieve grant compliance, organizations must ensure that they are properly preparing for and following through on any requirements laid out by the granting agency. This includes:

-

Submitting applications accurately.

-

Meeting all deadlines.

-

Managing finances in accordance with regulations, and

-

Ensuring timely reporting of project progress.

Organizations must also maintain proper records throughout the entire process to demonstrate that funds were used appropriately and meet all other requirements set forth by the granting agency. As such, organizations should also recognize that grant compliance does not just mean adhering to rules - it is about creating a culture within your organization where everyone understands the importance of complying with all rules related to grants.

Which grants require compliance?

While grant requirements can vary greatly, all grants that are given by grantmaking organizations require compliance by both the grant givers and the grant receivers. Compliance is even more critical where federal funds are involved or if you need to comply with certain regulations such as those outlined by the Americans With Disabilities Act (ADA) or Title VII of the Civil Rights Act of 1964.

Additionally, some state and local government grants might have specific rules that must be followed in order to receive funds. It's important to read all guidelines carefully before submitting your application so you know exactly what type of compliance may be necessary.

In cases where federal grants are involved, fines can be implemented against grant recipients that do not comply with the rules of the grant. Even when federal grants are not involved, a grantmaking organization can stipulate that a recipient must pay back the funds received if compliance requirements are not met.

CHAPTER 2

Why Is Grant Compliance So Important?

Grant compliance is an important element of grant management and must be taken seriously. It's the responsibility of grantees to understand and adhere to all applicable rules and regulations when managing a grant. Knowing what you need to do in order to remain compliant is vital for successful grant implementation, as failure to do so can lead to serious consequences for recipients.

The purpose of compliance is two-fold.

-

First, it ensures that grants are used for their intended purpose with proper oversight.

-

Second, it protects organizations from potential legal or financial liabilities by ensuring funds are managed responsibly.

Grant compliance requires that all activities related to the award comply with existing laws, regulations, policies and procedures set forth by sponsors and other regulatory entities like the Office of Management and Budget (OMB), for example. This includes making sure that all expenditures are properly documented, monitored and tracked throughout the entire lifespan of a project.

CHAPTER 3

4 Best Practices for Successful Grant Compliance

There are four key best practices for ensuring compliance with the grantor's rules and regulations. We covered them in a post on the blog, but we’re recapping them here. They include:

-

Researching the grantor's requirements.

-

Appointing a compliance owner.

-

Maintaining the required documentation, and

-

Effectively managing data collection.

Research the grantor’s requirements

Writing a successful grant proposal can be a daunting task, but it doesn’t have to be. By understanding the requirements of the funding organization and researching best practices for successful grant compliance, anyone can create a compelling proposal that stands out from the competition.

Before beginning to write your proposal, take time to research the funding organization and its goals. Find out who they are targeting with their grants and what kind of projects they help fund. This is important in order to tailor your proposal and make sure it meets their specific criteria. Additionally, review all of the information provided by the organization on how to apply for a grant including any deadlines or other restrictions.

It is also essential to understand best practices for successful grant compliance during all stages of writing your proposal in order to increase your chances of securing the funds you need.

Appoint a compliance owner

As grantmakers look to fund initiatives that support their mission, they must also recognize the importance of grant compliance – the process of making sure all rules and regulations are followed when disbursing and managing grant money. To ensure successful grant compliance, organizations should appoint a Grant Compliance Owner who is responsible for overseeing the process from beginning to end. The Grants Compliance Owner will help ensure best practices are upheld throughout every step of the grants management cycle.

The first step in appointing a Grant Compliance Owner is to identify someone with sufficient knowledge and experience in grants management. This person should have both an understanding of organizational policies as well as a clear understanding of all applicable laws within their jurisdiction. They will be tasked with creating processes, procedures, and internal controls to guarantee successful grant compliance.

Maintain the required documentation

Maintaining the required documentation for successful grant compliance is an important part of any organization's best practices. Proper record keeping and documentation can help ensure that all grant requirements are met, leading to a successful grant experience. Understanding how to properly maintain records can save time and money in the long run, as well as providing assurance that all grant regulations have been followed.

Documentation should include any records related to the grant application process, such as contact information for key staff members involved in the project, letters of agreement with vendors and subcontractors, budgets and spending records, reports on activities conducted under the project, data collected during project implementation or evaluation phases, personnel files related to those working on the project, etc. All documents should be stored securely and remain accessible at all times.

Effectively manage data collection

Organizations should select someone that will be responsible for managing their data collection. This person should ensure data is collected accurately and securely, and they must be aware of data collection and privacy laws. It's also important for organizations to make use of established systems like encryption or two-factor authentication to protect collected data from cyberattacks or unauthorized access.

Additionally, organizations need to create an audit trail that clearly documents when and how data was collected, as well as any changes made throughout the process. Regular reviews of this audit trail should be conducted in order to identify any discrepancies or inaccuracies that might occur over time.

CHAPTER 4

What Are the Laws and Regulations in Relation to Grant Compliance?

Grant compliance is governed by a complex web of laws and regulations at the federal, state, and local levels. Organizations that receive grant funding must adhere to these laws and regulations to ensure compliance with the grant terms.

Federal laws and regulations

The Office of Management and Budget (OMB) Circulars: These circulars guide federal financial management and grant compliance for organizations that receive federal funds. The most relevant circulars for grant compliance are OMB Circular A-110, which covers administrative requirements, and OMB Circular A-122, which covers cost principles.

The Federal Grants and Cooperative Agreements Act: This law establishes the legal framework for federal grants and cooperative agreements, including the terms and conditions of the grant and the grantor's rights and responsibilities.

The Federal Acquisition Regulation (FAR): This regulation guides procurement, including the requirements for grant compliance.

The Single Audit Act: This act requires organizations that expend $750,000 or more in federal funds in a fiscal year to have an annual audit, which includes compliance with the grant terms.

State and local laws and regulations

State procurement laws: Many states have procurement laws that govern the process of accepting and managing grant funds. Organizations should research their state's procurement laws to ensure compliance.

State open records laws: Many states have open records laws that require organizations to disclose certain financial and programmatic information. Organizations should be familiar with their state's open records laws to ensure compliance.

Special laws and regulations

Civil Rights laws: Organizations that receive federal funds must comply with federal civil rights laws, including Title VI of the Civil Rights Act of 1964 and Title IX of the Education Amendments of 1972. These laws prohibit discrimination based on race, color, national origin, sex, and other protected characteristics.

Environmental laws: Organizations that receive federal funds may be subject to federal environmental laws, such as the National Environmental Policy Act (NEPA) and the Clean Air Act. Organizations should research the specific laws that apply to their project to ensure compliance.

Other special laws: Depending on the nature of the project, organizations may also be subject to other special laws and regulations, such as labor laws, immigration laws, and data privacy laws. Organizations should research the specific laws that apply to their project to ensure compliance.

Federal laws and regulations include the Office of Management and Budget (OMB) Circulars, the Federal Grants and Cooperative Agreements Act, the Federal Acquisition Regulation (FAR), and the Single Audit Act. State and local laws and regulations include state procurement laws, state open records laws, and special laws such as civil rights laws, environmental laws, and other special laws like labor laws, immigration laws, and data privacy laws. Organizations should research the specific laws that apply to their project to ensure compliance.

For a more in-depth breakdown, read our post about the laws and regulations in relation to grant compliance.

CHAPTER 5

What Is Grant Reporting?

Grant reporting is a way for grantors to keep track of how their funds are being used, and it is also a way for grantees to demonstrate that they have fulfilled the terms of their agreement with the grantor.

The process of grant reporting typically involves providing financial data and other information related to the implementation of programs or projects that were funded by a particular grant. This may include descriptions of how money was spent, outcomes achieved, challenges encountered, successes celebrated and lessons learned during the course of a project or program. Grant reports can take different forms such as narrative summaries, financial statements and performance evaluations. These documents should provide insight into what worked well and what could be improved in order to better meet program goals in future grants.

CHAPTER 6

What Is the Difference Between Grant Compliance and Grant Reporting?

Think of grant compliance and grant reporting as two sides of the same coin. They serve different purposes and have different requirements. For a full breakdown, check out this post on the blog. However, here’s the gist of what you need to know about the differences between the two:

Grant compliance is an ongoing process of ensuring that a nonprofit organization meets the requirements set forth by a granting agency for the administration, management and reporting of funds awarded. This includes understanding and adhering to federal, state and local regulations, as well as any specific terms or conditions outlined by the funder. It also requires documenting all decisions made throughout the life cycle of a grant agreement.

In contrast, grant reporting is simply documenting how funds were used after they have been granted. This includes providing financial statements outlining income received and expenses incurred; programmatic reports detailing activities undertaken with those funds; and narrative descriptions describing outcomes achieved with their support. Grant reporters must be able to clearly explain why certain programmatic or fiscal decisions were made in order to satisfy the requirements outlined by funding agencies.

Related: Read our post “What is Grant Reporting, and Why Is It Needed?”

CHAPTER 7

How to Write a Great Grant Report

To make a great grant report, it is important to focus on the following:

- Be clear and concise in your writing.

- Use simple and easy-to-understand language.

- Use data and/or statistics to support your claims.

- Your grant report should be accurate and complete.

- Proofread your report for errors.

- Use visual aids such as charts, graphs, and tables to make the report more engaging.

- Include a conclusion that summarizes the key points of the report.

- Make sure that the report is visually appealing and easy to read.

Related: Read our post “5 Grant Reporting Best Practices You Need to Follow”

Pro Tip: Always thank the funder

It's important to remember to always thank the funder in your grant report. A simple thank you note at the beginning of the report can show your gratitude for their support and investment in your organization. It also helps to establish a positive and professional relationship with the funder, which can be beneficial for future funding opportunities. Additionally, acknowledging the funder's contribution to your report can be an opportunity to express the difference their support made in the project and how it benefited the community or the intended audience.

CHAPTER 8

4 Best Grant Reporting Software Options, in Brief

Each of the software solutions we’re covering below offer unique features and benefits that can help organizations streamline their grant reporting process and ensure compliance. Whether you're a small non-profit or a large corporation, one of these software options is bound to meet your grant reporting needs. Four of the best grant reporting software options available include:

-

SmarterSelect.

-

Submittable.

-

Serenic Navigator, and

-

Bloomerang.

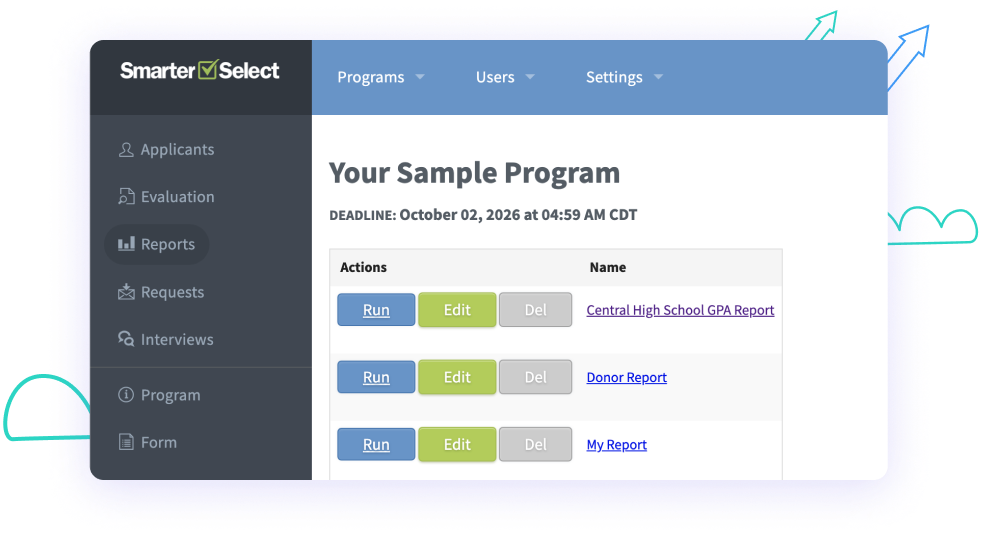

SmarterSelect is a user-friendly grant reporting software that simplifies the grant application process and allows for easy tracking and reporting of progress. The software has a simple and intuitive interface, making it easy for organizations of all sizes and levels of technical expertise to use. One of the standout features of SmarterSelect is the ability to track and report on multiple grants simultaneously, saving time and resources. Additionally, the software offers a range of customization options, allowing organizations to tailor the application and reporting process to their specific needs.

In comparison to the other software options, SmarterSelect stands out for its ease of use and flexibility. The simple interface and wide range of customization options make it a great choice for organizations of all sizes and levels of technical expertise. Additionally, the ability to track and report on multiple grants simultaneously sets SmarterSelect apart from its competitors.

Submittable is a cloud-based grant reporting software that streamlines the grant submission process and allows for easy collaboration and communication between grantees and funders. The software offers a range of features, including a customizable submission form, automated notifications, and detailed analytics. One of the standout features of Submittable is the ability to collaborate on grant applications and reports in real time, which can save time and resources. Additionally, the software offers a range of customization options, allowing organizations to tailor the application and reporting process to their specific needs.

Submittable has strong collaboration features, which can save time and resources. The customizable submission form, automated notifications, and detailed analytics allow for easy communication between grantees and funders. Additionally, the software offers a range of customization options, allowing organizations to tailor the application and reporting process to their specific needs.

Serenic Navigator is a comprehensive grant reporting software that offers financial management, grant tracking, and compliance management all in one platform. The software has a range of features, including real-time financial reporting, automated workflow processes, and compliance management. One of the standout features of Serenic Navigator is the ability to manage all aspects of the grant process in one platform, from application to reporting, which can save time and resources. Additionally, the software offers a range of customization options, allowing organizations to tailor the application and reporting process to their specific needs. This software is particularly useful for organizations that have multiple grants and need to ensure compliance with various regulations.

Bloomerang is a donor management software that includes a grant management module, allowing organizations to track and report on grant progress, as well as manage donor relationships. The software offers a range of features, including a donor database, automated communications, and detailed analytics. One of the standout features of Bloomerang is the ability to manage both donor and grant relationships in one platform, which can save time and resources. Additionally, the software offers a range of customization options, allowing organizations to tailor the application and reporting process to their specific needs. This software is particularly beneficial for organizations that have multiple funding sources and want to manage all the donor and grant data in one central location.

For a deeper dive into these four grant reporting software options, click here .

CHAPTER 9

Which Grant Reporting Software is Best?

Compared with other options on the market, SmarterSelect grant management software stands out as the best for its cost and features. It offers a comprehensive set of tools that allow organizations to manage their grants efficiently, effectively, and transparently. The software is designed with a user-friendly interface and is easy to navigate, making it accessible to all users, regardless of their technical expertise.

SmarterSelect provides in-demand features grant organizations like yours need such as grant application management, grantee reporting, and award tracking. These features make it easier for organizations to manage their grants and ensure that the funds are being used for their intended purpose. The software also integrates with other systems and platforms, making it possible for organizations to streamline their grant management processes.

One of the biggest advantages of SmarterSelect is its affordability. The software offers a wide range of features at a fraction of the cost of other grant management software solutions on the market. This makes it an excellent option for smaller organizations with limited budgets who still want to take advantage of the benefits of grant management software.

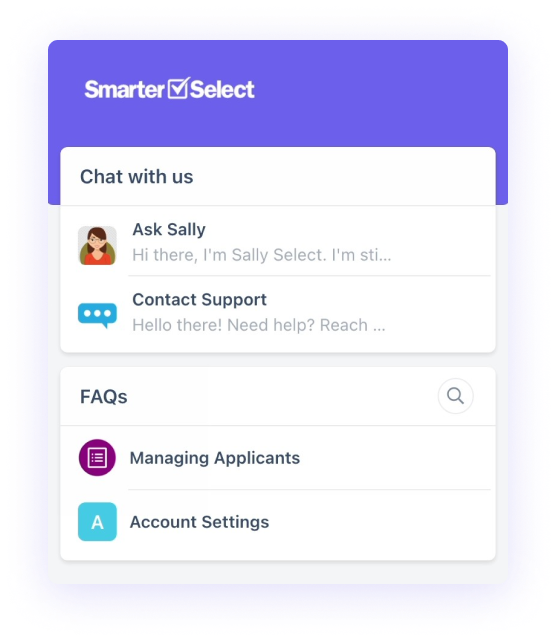

Finally, SmarterSelect provides outstanding customer support. The company offers on-demand training, email support, and a full knowledge bank of helpful articles ensuring users can get the assistance they need quickly and efficiently. The software is regularly updated with new features and users have access to our community forum to get ideas and inspiration from their fellow grant makers and scholarship managers.

We feel our software provides organizations with the critical tools they need to manage their grants efficiently and effectively, making it an excellent choice for organizations of all sizes. But don’t take our word for it that SmarterSelect grant management software is the best in the market for its cost and features. Try it for yourself for free. Click here to get started today!

Table of Contents

- Introduction

- What Is Grant Compliance?

- Why Is Grant Compliance So Important?

- 4 Best Practices for Successful Grant Compliance

- What Are the Laws and Regulations in Relation to Grant Compliance?

- What Is Grant Reporting?

- What Is the Difference Between Grant Compliance and Grant Reporting?

- How to Write a Great Grant Report

- 4 Best Grant Reporting Software Options

- Which Grant Reporting Software is Best?

Start Managing Your Scholarship Funds Better with SmarterSelect.

Priced for non-profits. No set-up fees.

No long-term contracts. Powerful features.

Go live in less than 24 hours.